Is your church selling property? Or has already sold property? What comes next?

How can local church trustees and leaders invest and manage financial assets from a property sale in accordance with The Book of Discipline ¶ 2543?

When circumstances lead to the sale of church property, The UMC’s Book of Discipline ¶ 2543 requires careful and committed stewardship of the proceeds. These funds are not for current operating expenses. However, your church has options for funding ministry within the fiduciary obligations of the connectional system under ¶ 2543.3. Read about the possibilities below.

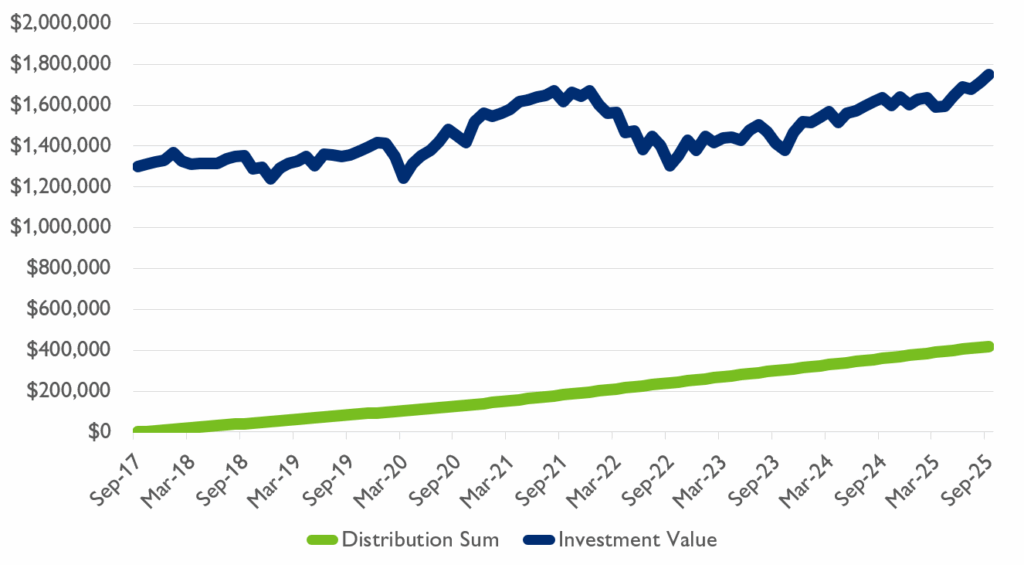

Here is an example of a local church that sold property in 2017 and invested $1.3 million with the Foundation in September 2017. Through broad diversification, monthly distributions, and a disciplined spending policy of 4% on the average balance of the preceding 12 quarters, the church has received $420,000 in eight years of ministry and retained nearly $1.8 million in property proceeds in September 2025.

What about the Trust Clause?

The UMC’s Trust Clause ¶ 2501 and the requirements of ¶ 2543 work together to safeguard United Methodist resources, maintaining our connectional accountability while empowering local ministry.

By creating a quasi-endowment with your sale proceeds, you extend the fundamental principles of the Trust Clause. You are ensuring that the financial value derived from your physical property continues to be reinvested, supporting ongoing ministry and mission within your local community and beyond.

How do quasi-endowments uphold the Trust Clause?

- Continuity of purpose: Even when physical property is sold, its financial value continues to support United Methodist ministry well into the future.

- Flexibility within structure: Quasi-endowments offer a flexible mechanism for reinvesting assets, benefiting your local church and ministries across the connection.

- Long-term stewardship: Just as the Trust Clause protects physical assets, quasi-endowments safeguard the financial resources derived from those assets for future generations.

What about the restrictions of ¶ 2543?

The Book of Discipline clearly restricts proceeds from the sale of church or parsonage property:

“The principal proceeds of a sale of any such property shall not be used for the current budget or operating expense of a local church.” – Book of Discipline ¶ 2543.1

An exception may be granted for a multi-year redevelopment plan according to ¶ 2543.3. The principal should be invested to support future missional and housing needs, often through the creation of a quasi-endowment.

These arrangements should be made with your District Superintendent.

Frequently Asked Questions (FAQ)

1. What is a “quasi-endowment” and how does it relate to ¶ 2543?

A quasi-endowment is a fund that a non-profit’s governing board (your local church trustees) chooses to restrict, mirroring the investment and spending guidance of a “true endowment.” The General Conference’s actions under ¶ 2543 create the opportunity for this revocable restriction, ensuring the principal is safeguarded for long-term ministry.

2. Does the Annual Conference control these funds?

No. The quasi-endowment is “owned” by the local church, under the supervision of the local church trustees (¶ 2533). Midwest Methodist Foundation acts as a trusted, independent partner to administer and manage the funds, in compliance with both United Methodist Church and state law.

3. What is the role of Midwest Methodist Foundation?

The Foundation is an independent 501(c)(3) public charity that has acted as a trusted fiduciary for more than 75 years. We administer and manage trust funds, diligently following legally binding documents and ensuring your church retains control over key decisions:

- Local church signature authorities and control

- Investment allocation and spending policy

- Online access to statements and account management responsibilities

4. Why should we partner with Midwest Methodist Foundation?

Partnering with us provides peace of mind. Our structure and safeguards ensure local church trustees and staff meet their legal and fiduciary responsibilities under United Methodist Church and state law. We help you create a secure, legal quasi-endowment structure that preserves your assets’ value and purpose, even as personnel and circumstances change.

Take the next step for your ministry’s future!

Fulfilling your duty under ¶ 2543 to invest property sale proceeds is a powerful act of faithful stewardship. We are here to help you secure a sustainable financial future for your mission.

Contact us today to discuss creating your church’s quasi-endowment and transforming assets into long-term ministry impact!

The Book of Discipline of The United Methodist Church

¶ 2543. Restriction on Proceeds of Mortgage or Sale11—1. No real property on which a church building or parsonage is located shall be mortgaged to provide for the current budget or operating expense of a local church. The principal proceeds of a sale of any such property shall not be used for the current budget or operating expense of a local church. Provided that provisions are made for the current and future missional needs of the congregation and the current and future housing needs of a pastor, the principal may be used for capital improvements beyond the regular operating budget when written approval is granted by the district superintendent and pastor. This provision shall apply alike to unincorporated and incorporated local churches.12

2. A local church, whether or not incorporated, on complying with the provisions of the Discipline may mortgage its unencumbered real property as security for a loan to be made to a conference board of global ministries or a city or district missionary society, provided that the proceeds of such loan shall be used only for aiding in the construction of a new church.

3. Exception to this restriction may be granted in specifically designated instances to allow use of equity and/or accumulated assets from the sale of property to provide for congregational redevelopment efforts including program and staff. Such exception may be granted by the annual conference, the bishop, and the cabinet upon request of the local church in consultation with congregation development staff where applicable. A clear and detailed three-to-five-year redevelopment plan that projects a self-supporting ministry must accompany the request.

11 See Judicial Council Decision 688.

12 See Judicial Council Decision 399.